How to Insure Your Business Against Inevitable Mistakes?

- Dec 11, 2025

- 2 min read

Updated: Dec 19, 2025

Have you ever wondered what the cost of one small, mechanical error is?

Imagine the situation: it’s the end of the month, the previous month’s declarations have been submitted, and taxes have been paid.

You are at ease because you trust your accountant.

They are a professional, after all, aren't they?

But one day, a notice arrives from the Revenue Service - your company is scheduled for a tax audit.

Suddenly, a thousand thoughts start spinning in your mind.

What follows an incorrectly calculated and paid tax?

A fine.

A penalty.

Why does this happen?

The answer is simple and quite banal: the accountant is also human.

Why is the “Human Factor” the #1 Risk to Your Business?

You'd agree that no matter how highly qualified a specialist is, fatigue, lack of focus, personal problems, or simply the "habit of the eye" caused by routine are factors that make working with a private (individual) accountant a constant risk.

The main problem is not the mistake itself.

Everyone makes mistakes.

The main problem is that when an accountant works alone, no one checks their work.

They are both the executor and their own auditor.

Unfortunately, practice shows that finding your own mistake is the hardest thing, and when the tax authority's audit discovers this mistake, it's already too late.

System vs. Individual: Why is AccurAi the Guarantee of Your Peace of Mind?

We understand well that a business needs not just an accountant, but a system of security.

That is why, at AccurAi, your finances are managed not by one specific individual, but by an entire team.

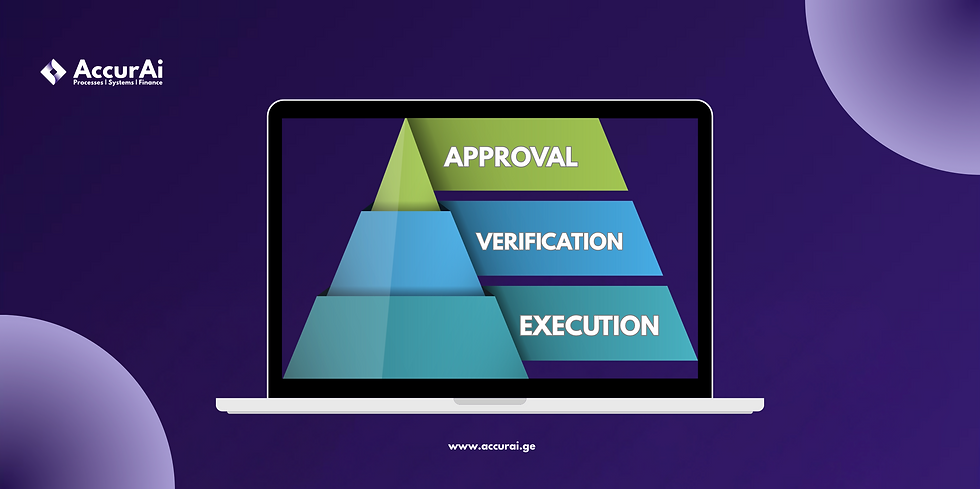

We have changed the rules of the game and replaced individual responsibility with a three-stage control mechanism.

Here is how we eliminate the probability of error:

1️⃣ Stage: Execution A qualified accountant organizes the primary documentation, processes transactions, manages data, and prepares declarations.

2️⃣ Stage: Cross-Check – A senior accountant gets involved. They look for inaccuracies that might have been overlooked in the first stage.

3️⃣ Stage: Confirmation – This is the final filter.

At this stage, the data undergoes final validation.

Complex and/or non-standard operations go through a financial consortium where the best accounting and tax practices are discussed to account for the operation in the best way for the business.

The Result? A Business Insured Against Tax Risks

You are no longer dependent on one person’s workload, industry competence, mood, health status, or degree of fatigue.

In AccurAi’s case, the system works like clockwork so you can concentrate on what is truly important - the growth of your business.

Don’t entrust your financial security to luck.

Trust the team that passes every figure under a triple magnifying glass.

Ready to make peace of mind the standard for your business?

📩 Contact us today!

Get a free consultation and receive an offer tailored exactly to your needs.

Comments